The future of 2290 online filing and how it's changing tax prep for truckers

The future of 2290 online filing and how it's changing tax prep for truckers

Blog Article

The IRS is always working to help improve the way taxes are filed and submitted. More and more people are choosing E-file to submit their taxes to the IRS. After an overwhelming response to E-filing in 2008 the IRS decided to improve this method of filing for 2010. Most of the accountant and CPA in New York and other cities have found it an easier way of filing taxes as it saves time.

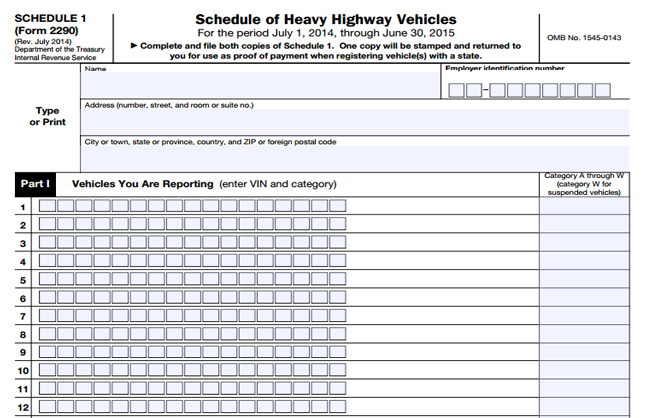

The best method for doing this is through the use of e-forms. These are now easily available on relevant websites. One such form is the 2290. Filling out the form is essential if you operate trucks on public roads. To ensure a quick filing of the necessary forms, there is now a facility for form 2290 tax form electronic filing.

A Form 2290 online 2290 can be filed at any time after the deadline has passed but the tax due may be subject to penalties and interest. The penalty for failing to file IRS Form 2290 in a timely manner is equal to 4.5 percent of the total tax due, assessed on a monthly basis up to five months. Late filers not making an HVUT payment also face an additional monthly penalty equal to 0.5 percent of total tax due. Additional interest charges of 0.54 percent per month accrue as well. Once you have submitted your Form 2290, the IRS will stamp your Schedule 1 as proof of payment.

The provision of section 234A and 234B or levy of interest shall be applicable. The penalty for concealment can be escaped if disclosure is made in the statement during search for the years for which the due date for filing return of income has not expired in respect of search initiated before 01.06.2007. When source of income declared u/s 132(4) is not questioned in the statement, the immunity cannot be denied on the ground that assessee did not indicate the source of deriving undisclosed income. (CIT v. Radha Krishan (278 ITR 454) (All).

Your taxes are calculated on how much your property is worth. That is the home value. IRS heavy vehicle tax estimators consider the building and the size of this building. Real estate tax is calculated based on if your home is modern, large, and the condition of the exterior structure. If you have kept your home updated, the value increases on your home. This causes your taxes to increase. However, you have more equity. This means that if you apply for home equity loan or a second mortgage on your property, you can get more money.

Before operating the crane, operators should carefully read and understand the operation manual from the crane manufacturer. Further, they must always note any instructions given by a reliable instructor or operator. It is also crucial for the crane operator to understand the consequences of careless operation of cranes. They must be instructed of the proper use, prohibition and the safety rules and regulation during the operation.

There's ample room inside to seat six individuals. It only takes 9.2 seconds 2290 tax form to reach speeds of 60mph from zero which is quite speedy for such a massive automobile. Pricing for the base model starts at around $44k and may vary depending on the options and trim selected. The Ram proves that it had what it takes in order to compete with the best of the best in the competitive truck segment. Report this page